R&D Tax Credits

What are R&D Tax Credits?

R&D tax credits are a government incentive designed to promote innovation in the UK, whilst simultaneously stimulating the economy. The scheme, run by HMRC since the year 2000, rewards companies who invest time and money into developing new (or improving existing) products, processes or services.

What Activities Do HMRC Consider as R&D?

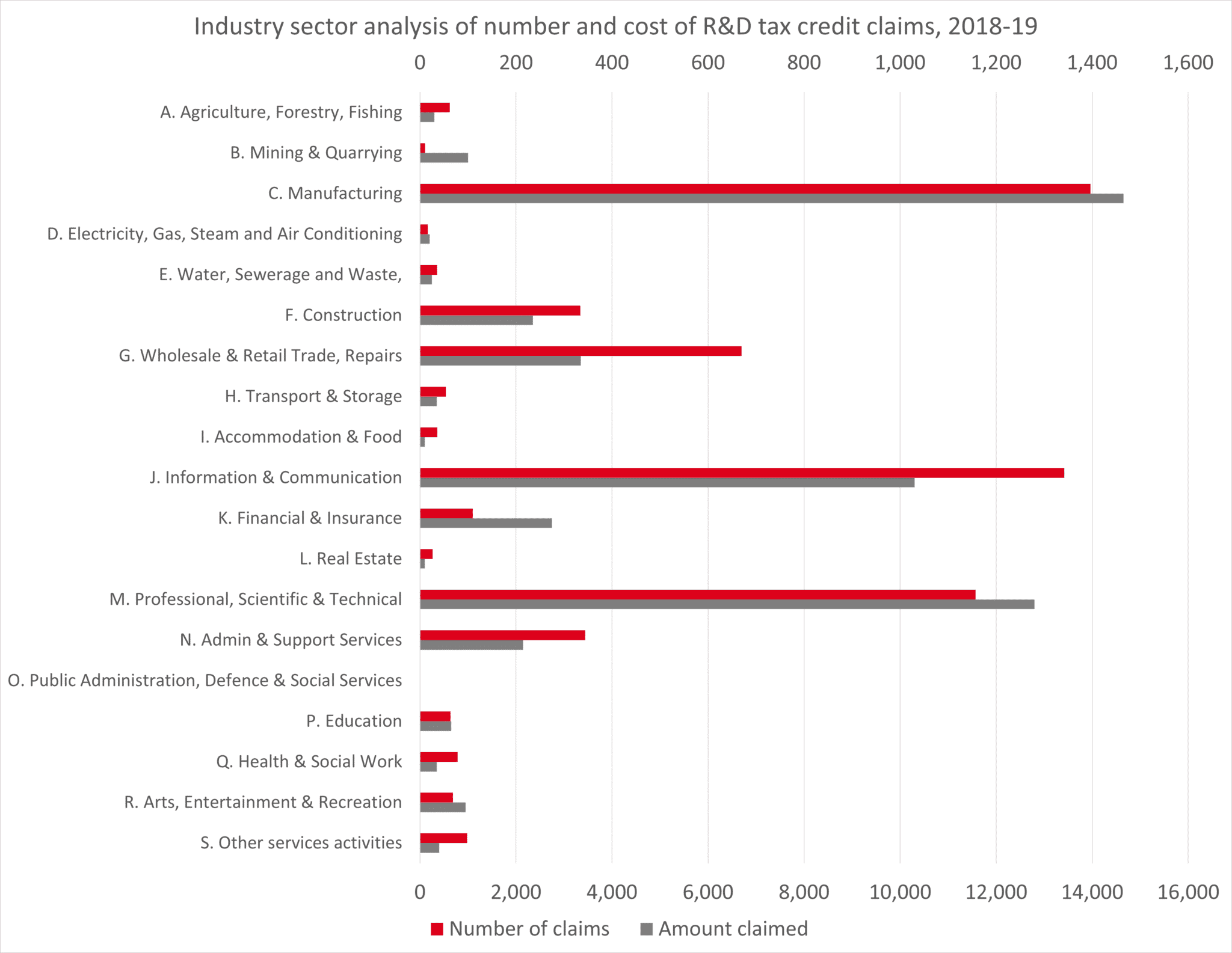

HMRC’s definition of R&D is much broader than most realise; the term R&D usually conjures up images of people mixing chemicals in a laboratory or developing rockets for spaceflight. In reality, it occurs in every industry, from jewellery manufacture to cyber security, and encompasses an array of activities, from the development of efficient internal software systems to new garment weaves with unique properties.

Who Can Apply for R&D Tax Credits?

There are two schemes which enable companies to recover their costs; the SME R&D tax credit incentive, for small and medium size firms, and the Research and Development Expenditure Credit (RDEC), which is primarily for large companies or SMEs in receipt of grant funding.

To find out if you’re eligible to recover your costs, contact our team today.

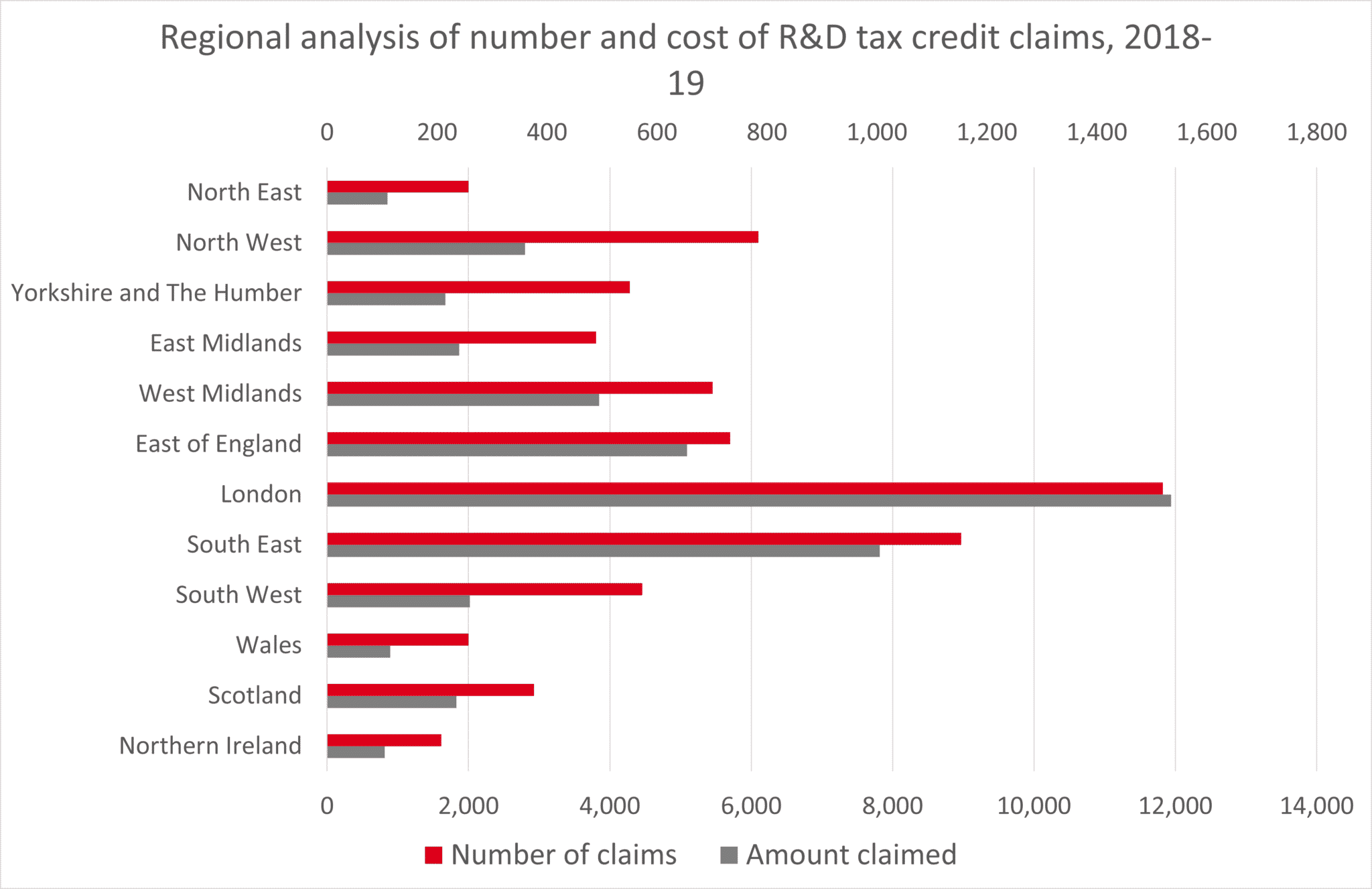

Key HMRC Statistics:

Between the scheme’s launch in 2000/01 and 2018/19, over 300,000 claims have been made with over £33.3bn in tax relief being claimed.

The total number of claims for 2017/18 was 62,095, an increase of 17% from 2016/17.

Over £5.1bn in support was claimed during the 2017/18 period, an increase of 15% from 2016/17.

£36.5bn of Qualifying Expenditure was isolated during the 2017/2018 period, and increase of 8% from 2016/17. 72% of this was claimed through the RDEC scheme, with the remaining 28% via the SME mechanism.