How Does the Benefit Work for the RDEC Scheme?

There are several ways in which R&D tax credit benefits can be realised; the method of recovery varies depending on the claimant’s tax position and profitability.

The Headlines

Following the changes to the R&D scheme, the RDEC net benefit as a percentage of qualifying expenditure has increased from 10.5%, up to 15% – 16.2% for expenditures incurred after the 1st of April 2023. However, the old percentages will still stand for any expenditures incurred before this date. This means that in some cases, R&D benefits could be determined by a combination of new and old ranges.

The Details

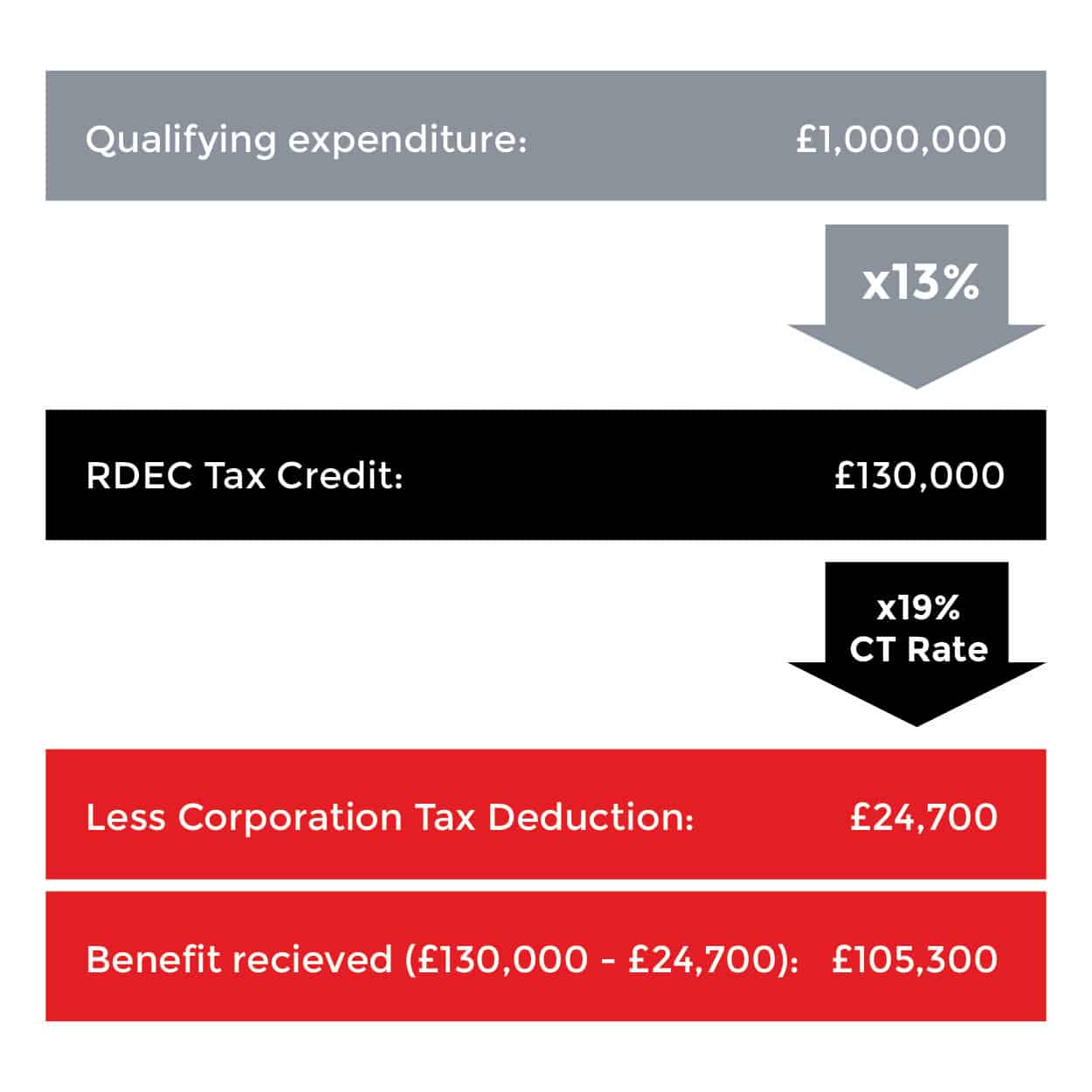

From 1st of April 2023, the RDEC scheme offers a tax credit of 20% of your qualifying expenditure. This tax credit is taxable at the Corporation Tax rate of 19% – 25%. As such, the actual benefit received will range between 15% – 16.2%.

However, the example below is based on a tax credit rate of 20% valid for expenditures incurred before the 1st of April 2023, and does not take into account the new corporation tax rates.

RDEC Tax Credit Rate

HMRC recently announced an increase in the RDEC rate from 13% to 20%, effective from 1 April 2023. A timeline of the RDEC rate can be seen below:

RDEC Rate Table

Date | Payable Credit | |||||

|---|---|---|---|---|---|---|

01/04/2013 | 10% | |||||

01/04/2015 | 11% | |||||

01/04/2018 | 12% | |||||

01/04/2020 | 13% | |||||

01/04/2023 | 20% | |||||

How the Credit is Applied:

The government have set out the following steps detailing how to apply the RDEC credit:

- The credit must be used to settle your Corporation Tax liability for the accounting period. However, you’ll need to pay Corporation Tax on the credit.

- If you have RDEC remaining after step 1, the amount is reduced by applying a notional tax charge to it. The notional tax charge must be based on the main rate of Corporation Tax for the accounting period. If the amount remaining after step 1 is higher than what the value of the total credit minus the notional tax charge would have been, you must use the value of the total credit minus the notional tax charge in step 3.

- The credit must not be higher than your company’s total expenditure on R&D workers’ PAYE and National Insurance contributions for the accounting period. The amount over this limit will be added to any expenditure credit in the next accounting period.

- The remaining amount is used to pay any outstanding Corporation Tax liabilities for any accounting periods.

- The credit can be surrendered in whole or part to any group member.

- The credit can be used to discharge any other company liabilities, like VAT or liabilities under a contract settlement.

- The final amount can be paid to your company.

Gov.UK (2020), Claim Research and Development (R&D) expenditure credit, Available At: https://www.gov.uk/guidance/corporation-tax-research-and-development-tax-relief-for-large-companies