How Different Types of Grants Impact R&D Applications

Grant funding is a great way for fast-growing, innovative businesses to propel their research and development (R&D) projects using money funded by the UK Government!

These grants range in size and can support a wide range of businesses. They are often used to fund projects seeking technological advances, but can also be awarded for other types of development as long as innovation takes place.

Businesses can receive grants if they are carrying out one of the following projects:

- Creation of new products, processes, or services

- Improvement of existing products, processes, or services

- Collaborate on research with other businesses

- Early feasibility study (limited clinical investigation of a device in the early development stages)

Whilst grant funding can have an impact on how the benefit from an R&D Tax Credit is received, the two can often be received together.

It’s worth remembering that the R&D incentive offers two different recovery mechanisms:

- SME (state aid): can recover between 18.85-33.35% of qualifying costs

- RDEC (not state aid): will recover 13% (worth 10.53%) of qualifying costs

As you can only receive one form of state aid for any given project, the receipt of grant funding (many forms of which are considered state aid) may impact your ability to recover your costs under the SME incentive.

Let’s see in the following examples what happens when a company compiling an R&D application has received grant funding.

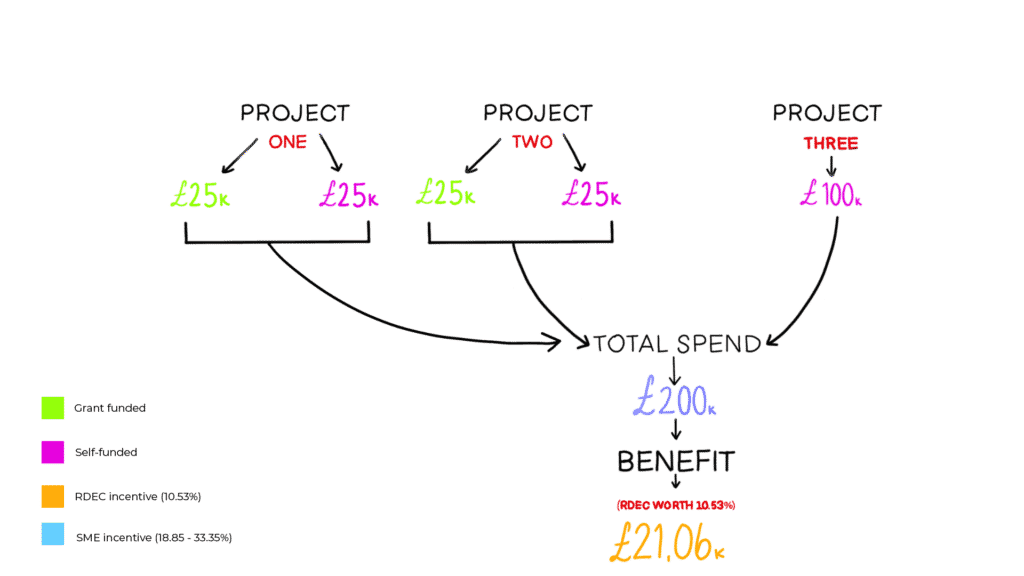

Non-project-specific state aid

Non-project-specific state aid can be awarded to companies with no boundary as to which R&D projects it can be used for. Whilst this funding can be used to support a range of different projects, all R&D projects carried out by the company needs to be considered under the RDEC mechanism.

EXAMPLE

The diagram shows an example of non-project-specific state aid being received by a company with a total R&D expenditure of £200k; £50k of this being grant funded, and the other £150k self-funded.

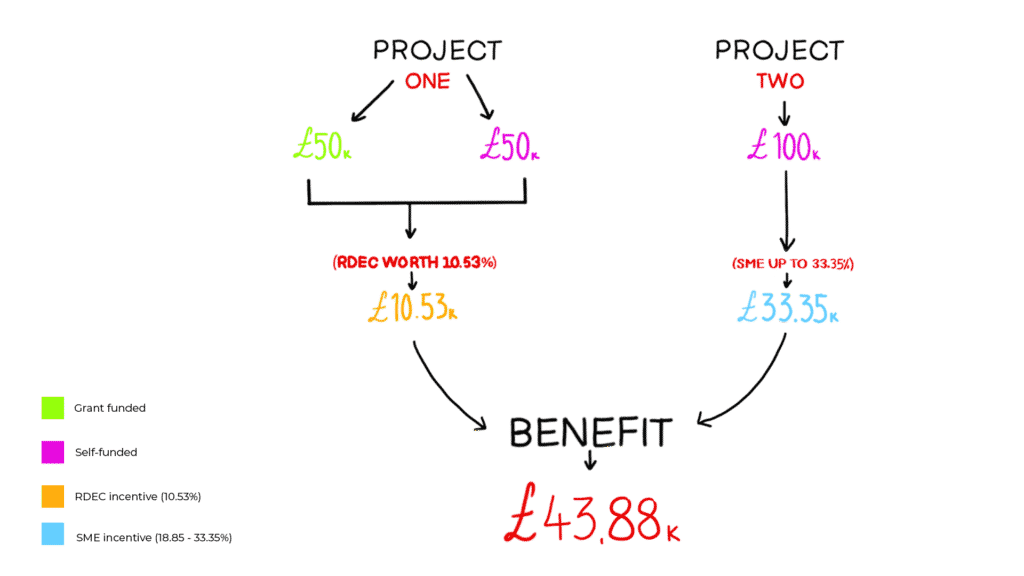

Project-specific state aid

Project-specific state aid is grant funding that has been awarded to fund one or more specific projects. The company may however still be carrying out R&D on other projects that have been self-funded.

EXAMPLE

The diagram shows an example of project-specific state aid being received by a company with a total R&D expenditure of £200k:

- Project one consists of the project-specific £50k grant and £50k of self-funding, both of which will be recovered under the RDEC incentive (worth 10.53% of qualifying costs)

- Project two is entirely self-funded and can be recovered under the SME incentive at between 18.85%-33.35% of qualifying costs (33.35% in the given example)

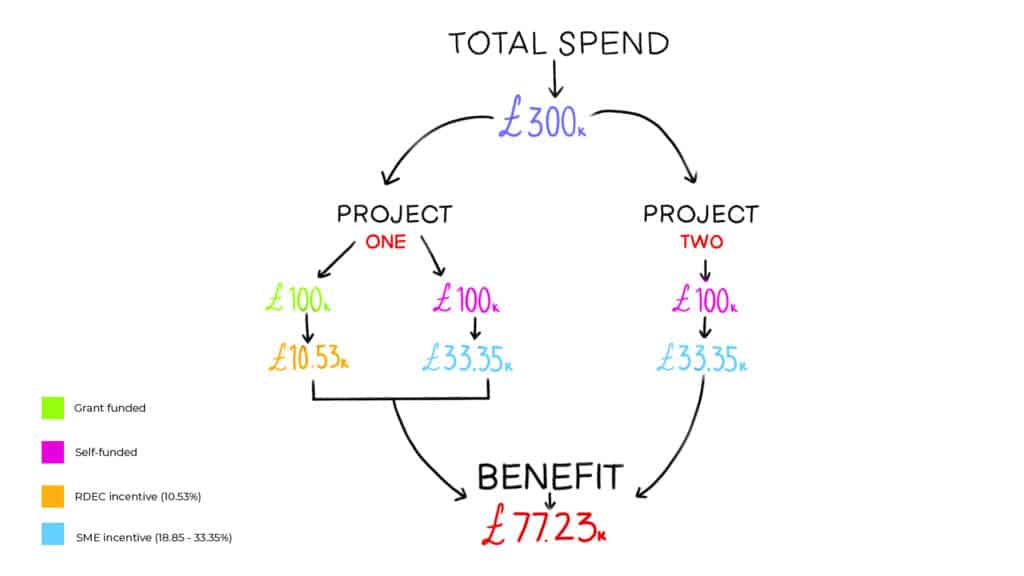

De minimis funding

If a company receives less than €200k across a three-year period, any grants received could qualify as de minimis aid. De minimis grants are not considered state aid as they are below a de minimis threshold.

In this scenario, the impact of this grant funding is limited to the amount that has been received through the funding (and therefore not self-funded).

The part of the project that has been grant funded will need to be considered under the RDEC incentive (worth 10.53%) however it wouldn’t prevent the rest of R&D spent from being recovered under the SME incentive at 33.35%.

EXAMPLE

The diagram shows an example of de minimis funding based on an R&D expenditure of £300k:

- Project one includes a grant of £100k (which is recovered under the RDEC incentive), and the other half of the project is self-funded and therefore recovered under the SME incentive

- Project two is entirely self-funded and therefore can be recovered under the SME incentive

Still unsure?

Speak to our expert Ben Hewitt - he'll be more than happy to chat about how grants work alongside R&D Tax Credits.

Click Here