Starting from accounting periods beginning on or after 1St April 2024, the RDEC and SME schemes have been merged into one consolidated framework with a single set of qualifying rules.

The merged scheme reshapes the R&D incentive, giving claimant companies a relatively short amount of time to get their heads around the new legislation and prepare for future claims.

It is therefore important to take the time to understand the implications of the merged scheme on your R&D application to avoid getting caught up in the changeover.

Implications of the merged scheme for claimants

The merged R&D scheme will replace SME and RDEC schemes, creating a unified set of qualifying rules applicable to companies of all sizes which should simplify access to relief. An above the line credit of 20% will be available to eligible companies under the merged scheme.

However, the eligibility criteria that define what qualifies as R&D remain unchanged under the new scheme. As such, claimant companies should still refer to the DSIT guidelines (which define R&D for tax purposes) in addition to the Guidelines for Compliance (GfC) (which expand on the DSIT).

The SME intensive scheme, which was initially announced in the Spring Statement 2023, will still remain in force, though a lower threshold has been introduced. This incentive – now known as the enhanced R&D intensive support (ERIS)– will allow companies spending over 30% (previously 40%) of their total costs on qualifying R&D activities to access a higher rate of recovery (up to 27% of their qualifying expenditure).

With the new merged scheme, the Government aims to provide clarity over which company within a contractual arrangement can make an application for R&D tax relief, something that could often be confusing under the previous legislation.

Under the new merged scheme, only the company initiating the R&D and bearing the financial risk associated with the realisation of the project will be able to claim tax relief.

As such, the implications of the new merged scheme on your R&D application will vary based on the specific circumstances of your business and the contractual arrangements establishing how R&D activities are carried out.

As an example, with the new merged scheme, SMEs will no longer be able to recover their costs when conducting R&D activities on behalf of a large company (previously allowable under the RDEC scheme). However, contracted companies may still be entitled to claim tax relief if they directly initiate R&D work that doesn’t form part of the R&D for the customer.

Merged R&D scheme: commencement date and rates of recovery

We understand that the numerous changes that have reshaped the R&D incentive in the past year or so could be rather confusing for many business owners who don’t have the time to read through extensive Government publications and keep up to speed with the new legislation.

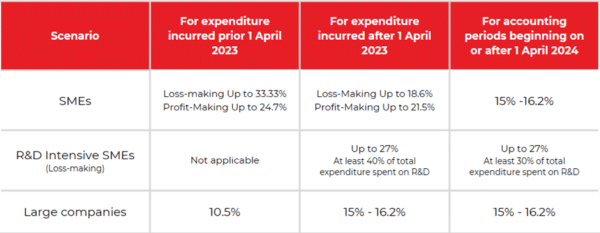

We have summarised how recovery rates have changed over the past year, highlighting the implications for different types of businesses in the table below:

In summary, the old rates of recovery will be applied for any R&D expenditures incurred before 1st April 2023, as indicated in the table above. Likewise, the rates of recovery introduced with the Autumn Statement 2022 will be applied for expenditure incurred after 1st April 2023. This means that, for year-ends spanning 1st April 2023 (for example a financial period of 1st January 2023 to 31st December 2023), R&D Expenditure before and after 1st April 2023 would be subject to different rates of recovery.

Finally, the rates of recovery of the merged scheme and, if applicable, the enhanced R&D intensive support for loss-making SMEs, will be applied for accounting periods beginning on or after 1st April 2024.

It’s important to note that, the new merged scheme will come into force for accounting periods beginning on or after 1st April 2024 and not for expenditure incurred on or after this date. This means a simplified transition from old rates of recovery to new ones, particularly for accounting periods spanning 1st April 2024, where it won’t be necessary to apply different rates of recovery.

Practically, if your business closes the financial year 31st December, you will claim under the merged scheme for the first time for accounting periods ending 31st December 2025.

How does the merged scheme work in practice?

The merged scheme is modelled on the RDEC scheme, with an aligned set of qualifying rules and a more visible above the line credit (20%) that will apply to all companies, regardless of size (with the exception of SMEs that fall under the R&D intensive scheme).

The credit received through the merged scheme can still be used to offset tax liabilities or paid as a tax credit.

Despite being based on the RDEC scheme, the merged scheme introduces some key changes to the previous legislation. We’ve analysed the main ones below.

Subcontracted R&D

Where R&D is subcontracted, the new scheme will allow the company making the decision to undertake the R&D to recover their costs. The merged scheme is designed to create a clear distinction over which company in an arrangement is able to claim R&D tax relief.

This should prevent two companies from claiming for the same R&D project, benefiting only the company who decided to undertake the R&D. Under the merged scheme:

- Companies will still be able to claim qualifying subcontractors costs.

- Subcontracted companies will no longer be able to claim their costs for work contracted to them. However, contracted companies may still be able to claim tax relief if they have to initiate R&D which does not form part of the customer’s R&D project.

For consistency, these changes will also apply to R&D intensive SMEs for accounting periods beginning on or after the 1st April 2024.

Subsidised expenditure

Under the new merged scheme, restrictions around subsidised expenditure will no longer impact claimant companies.

This is particularly relevant for SMEs, as the previous legislation included restrictions on the amount of tax relief available for grant-funded R&D projects.

Under the merged scheme (and ERIS), grant funding will no longer impact R&D tax relief claims.

Restrictions on eligible expenditure for overseas subcontractors

From accounting periods beginning on or after 1st April 2024, the previously announced restriction for overseas expenditure will come into effect (delayed from 1st April 2023).

In practice, only costs associated with subcontractors and externally provided workers undertaking R&D activities on behalf of the claiming company in the UK will be eligible.

However, there are still instances where companies will be able to claim the costs of overseas subcontractors such as if it is “wholly unreasonable” for the claimant company to carry out R&D activities in the UK.

PAYE cap

Under the merged scheme, the PAYE cap limits the amount of payable credit companies can receive for accounting periods where the cap applies. However, any excess of the cap can now be carried forward and will be part of the entitlement of the company for the next financial year.

The cap is calculated as £20,000 plus 300% of the company’s PAYE and National Insurance Contribution liabilities, which remains unchanged from the previous legislation.

It’s important to note that the cap doesn’t apply to all companies. Specifically, a company is exempt from the cap if:

⦁ is creating, preparing to create, or managing Intellectual Property and

⦁ does not spend more than 15% of its qualifying R&D expenditure on connected parties.

Summary

For accounting periods beginning on or after 1st April 2024, claimant companies will recover their R&D costs under the new merged scheme; however, enhanced support will be available for loss making R&D intensive companies.

The merged scheme will apply in the following instances:

- The claimant company has taxable profits for the period.

- The claimant company is loss-making but does not meet the intensity condition (SMEs that spend over 30% of total relevant expenditure on R&D).

The intensive incentive (ERIS) will apply if:

- The claimant company is a loss-making SME and over 30% of total relevant expenditure was spent on R&D.

It’s important to note that, loss-making SME intensive companies will be eligible under both the merged and intensive schemes. These companies will often receive a greater recovery by making a claim under the intensive scheme (with a recovery up to 26.97%); however, there are some scenarios where the benefit of claiming under the intensive scheme is marginal, or in fact, claiming under the merged scheme could generate a higher benefit.

Some of the technical implications for claimant companies that is worth bearing in mind are:

- New set of rules and rates of recovery will apply to establish the amount of tax relief a company is eligible for.

- Large companies can now recover the costs of R&D subcontractors.

- Grant funding will no longer lower the amount of tax relief available for companies.

- New rules to establish which company in an arrangement is able to claim R&D tax relief.

- Restrictions on eligible expenditure for overseas subcontractors.

Need support to navigate the new R&D merged scheme?

Apogee have you covered. Our experts can guide you through the implications of the merged scheme on your R&D application, ensuring you recover everything you’re entitled to through a maximised and fully compliant R&D claim.

As always, we are available to chat on 01527 357789. Alternatively, you can send us an email to info@apogee.co.uk and one of our team will get back to you as soon as possible.