The Ministry of Defence (MOD) has moved the first step toward additive manufacturing (AM), contracting five sector leader’s companies to start a collaboration aimed at exploring and overcoming the issues preventing UK Defence from fully exploiting the benefit of this technology.

By working closely with the MOD, the contracted companies will attempt to scale up the use of AM in the sector and strive for the development of innovative manufacturing solutions as a result.

If successful, this partnership will help build a resilient and sustainable supply chain for the UK Defence able to deliver on complex tasks in a time-efficient manner.

Additive manufacturing: an overview

AM, also known as 3-D printing, is a technology that is finding increasing applications in several industries.

While traditional manufacturing takes a block of solid material and cuts it until the final product is completed, AM builds objects by adding one layer at a time.

The first step for creating an object with AM is typically to design it through CAD software or replicate the design of an existing object through its scansion. The software translates the design into a layer-by-layer framework for the 3-D printer to follow, which begins to create the object.

The benefit of this technology is that it allows the production of highly optimised parts that would be extremely expensive and difficult to produce with traditional manufacturing processes.

Potential applications of Additive Manufacturing in the defence industry

The effective use of AM in Defence has the potential to generate important benefits for the industry. This technology can substantially cut the cost and production time of tools and parts, enabling the end user to receive products faster and at a more competitive price.

On a technical level, AM is expected to open new opportunities for design enhancement of parts or components. The use of AM would unlock the enhancement of specific qualities of parts such as weight reduction and increased resistance and durability, which are more difficult to achieve with traditional manufacturing processes due to time and cost limitations.

AM is also expected to impact the maintenance of military platforms. Due to their complex underlying structures, military platforms require customised spare parts and equipment components that with AM could be manufactured directly on-site, drastically reducing restoring times.

As a result, collaborating with AM sector leaders to exploit the full potential of this technology is likely to bring increased technical and commercial competitiveness to UK Defence, critical factors for the industry’s success.

Additive manufacturing: trends and areas of improvement

Although AM is already an established technology, there are still some areas of improvement.

Sustainability, for example, is currently one of the main trends impacting the industry. Many materials utilised in AM are in fact largely derived from oil-based sources and are difficult to recover and recycle because of their varied composition. Some polymers sourced from natural origins have been successfully utilised in AM, however, due to specific characteristics required such as viscosity and thermal properties, the number of naturally originated polymers suitable for AM is still limited. Research and development is therefore required to expand the range of environmentally sustainable materials that can be utilised in AM.

The integration of artificial intelligence (AI) and digital technologies is also set to be a major trend for the industry and is expected to reshape the future of AM. AI is likely to unlock new capabilities for AM, enabling sophisticated design optimisation and simulation to increase the efficiency of manufacturing processes. For example, AI algorithms can analyse complex geometrics and material properties to generate design recommendations for optimum strength and resistance of parts, while reducing material usage.

Furthermore, engineers can use AI to run simulations of how parts would perform under specific conditions to collect data and make informed decisions before initiating the printing process, saving substantial amounts of time and resources.

Furthermore, engineers can use AI to run simulations and observe how parts would perform under specific conditions, making informed decisions before initiating the printing process and saving substantial amounts of time and resources.

Design optimisation and simulation capabilities are indeed crucial for industries where material efficiency and product performance are essential such as Defence. Therefore, investing in the digitalisation of its supply chain is essential to boost the competitiveness of the UK Defence sector.

R&D tax relief opportunity for additive manufacturing companies

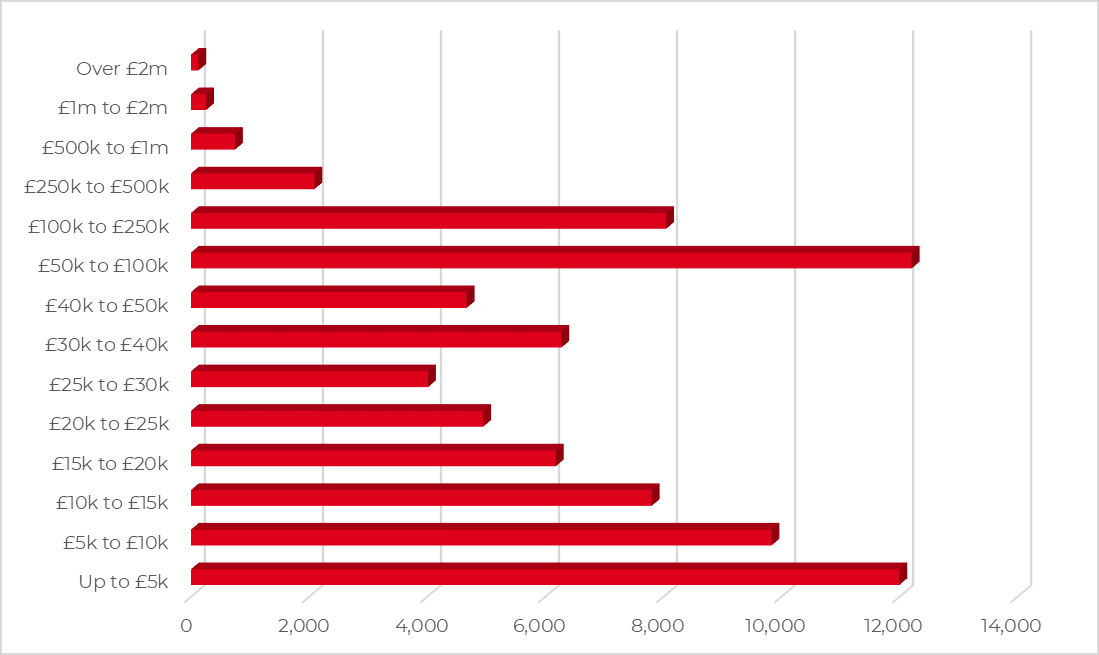

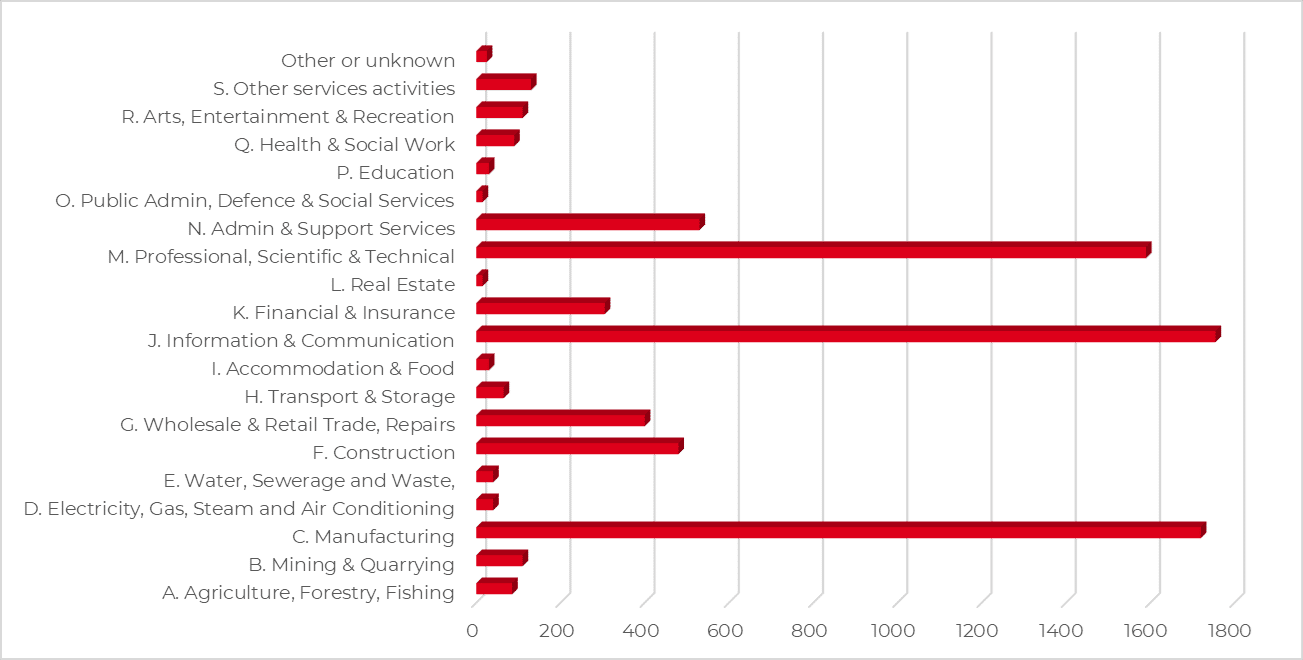

The future of AM brings an enormous opportunity for companies in the industry to benefit from HMRC’s R&D tax relief incentive when investing in projects attempting to enhance the underlying technology of AM.

Of course, undertaking a complex R&D project aiming to achieve the next innovation in AM is rather challenging. It could take years and failures along the way for the project to be successful.

As such, it’s important to remember that, even if an R&D project fails, the company conducting the work is still entitled to receive tax relief for the investment faced.

R&D is crucially related to advancing a specific field by overcoming technical challenges that cannot be easily worked out by an experienced professional. The outcome of the project, however, doesn’t influence its eligibility.

Proving or disproving that a specific method or process isn’t suitable to achieve the sought innovation is still considered an advance in the field.

Further, the project could still be ongoing at the time of the claim, meaning that alternative approaches to development are still being trialled.

If you need support with your R&D tax relief claim, please do get in touch. Our experienced team of experts will discuss your project with you and advise on how to proceed to get you everything you’re entitled to.

References:

- Manufacturing

Innovation – UK MOD teams up with industry to unlock the benefits of Additive

Manufacturing – Defence Equipment & Support - Additive Manufacturing Solutions secures UK Ministry of Defence contract – TCT Magazine

- Additive

manufacturing, explained | MIT Sloan - Additive

Manufacturing – an overview | ScienceDirect Topics - Additive

manufacturing in defence (europa.eu) - 2024

Additive Manufacturing Trends and Predictions (mitchellsson.co.uk) - What To Expect from Additive Manufacturing in 2024 | IndustryWeek