It’s undeniable that we’re living in the era of technology convergence! The term refers to the integration of two distinct technologies that merge to create a new outcome. From smartphones to drones, blockchain to 3D printers, the modern world is rich with examples of technology convergence and the Internet of Things is one of the most important. It goes beyond the transformation of technologies and creates a network of physical objects (such as devices, vehicles, or appliances) embedded with sensors, software, and network connectivity, simultaneously connected to each other with the ability to share and receive data.

Businesses are shifting from ‘traditional’ Information Technology (IT) to a more advanced Internet of Things (IoT). By 2023, it’s estimated that the number of connected devices will reach 43 billion, with the revenue pool for device-enablement platforms for the Internet of Things expected to reach €14.5 billion in the same year!

At this point, you may be wondering “Why are converged technologies becoming important?”

The answer can be summarised in two words; innovation and competitiveness.

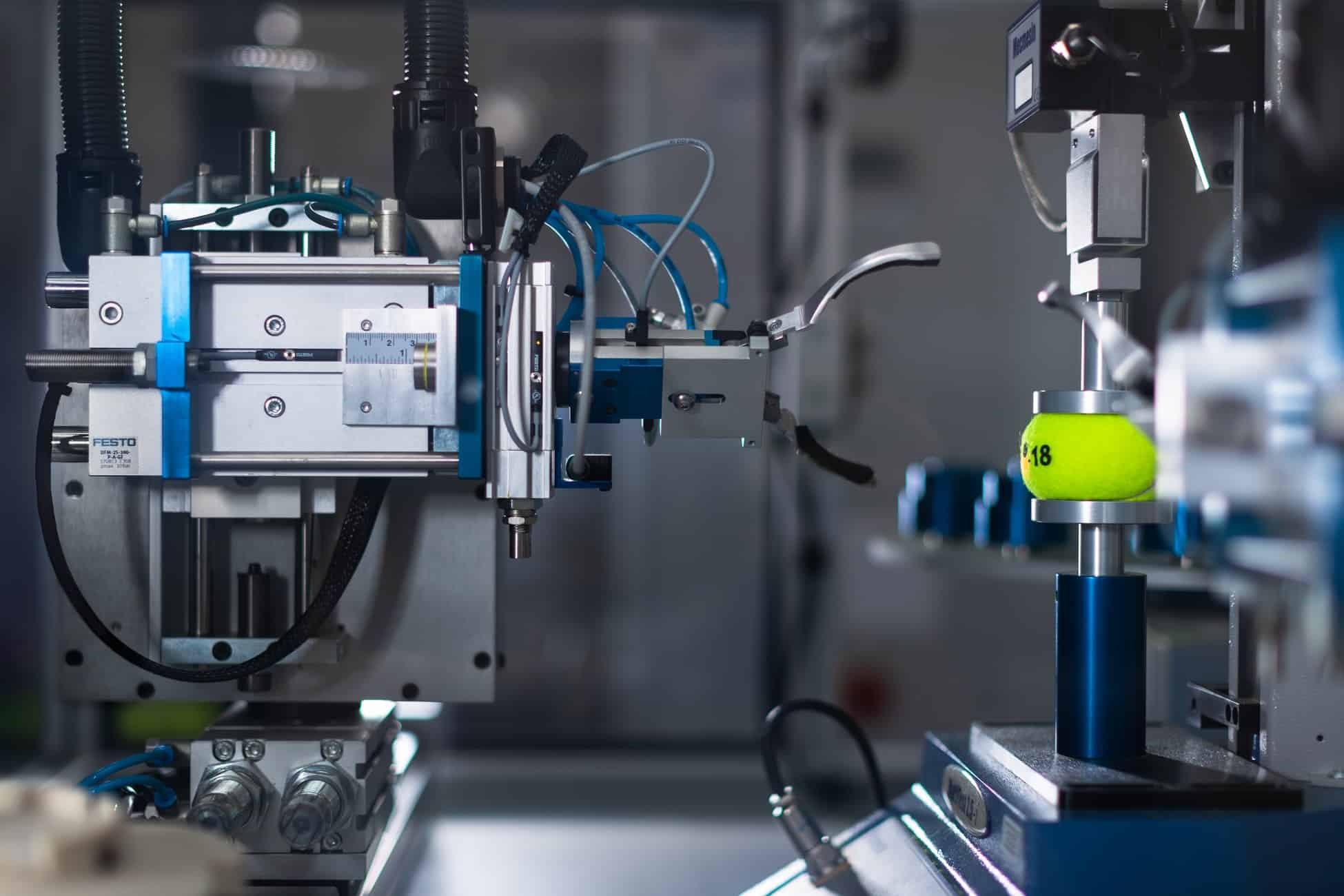

The Internet of Things is intrinsically linked to innovation and enhances the R&D process in many businesses. It has the potential to provide new tools for engineers and technicians to optimise prototyping processes, whilst providing analytical data able to predict the output, quality and lifecycle of new products by using digital twins.

The Internet of Things can also be embedded in machinery for the manufacturing process, and in the products themselves, creating an ecosystem that allows developers to conduct new projects with increased focus, to enhance the development of ongoing projects, and gather data to make informed decisions for further developments and new product lines. The analysis of the manufacturing processes can also help companies that are looking to improve on sustainability, to develop corrective initiatives that reduce waste and improve the sustainability of production.

Incorporating the Internet of Things in businesses and striving toward maximizing R&D efforts is the recipe for success in the modern marketplace. Companies are constantly evolving, concentrating on increasing their levels of resources toward innovation. The key to competitiveness in today’s marketplace is adaptation!

Integrating the Internet of Things into your operations is likely to make your business eligible for R&D tax credit relief. If that’s the case, get in touch with us at Apogee to see how we can help recoup your investment.