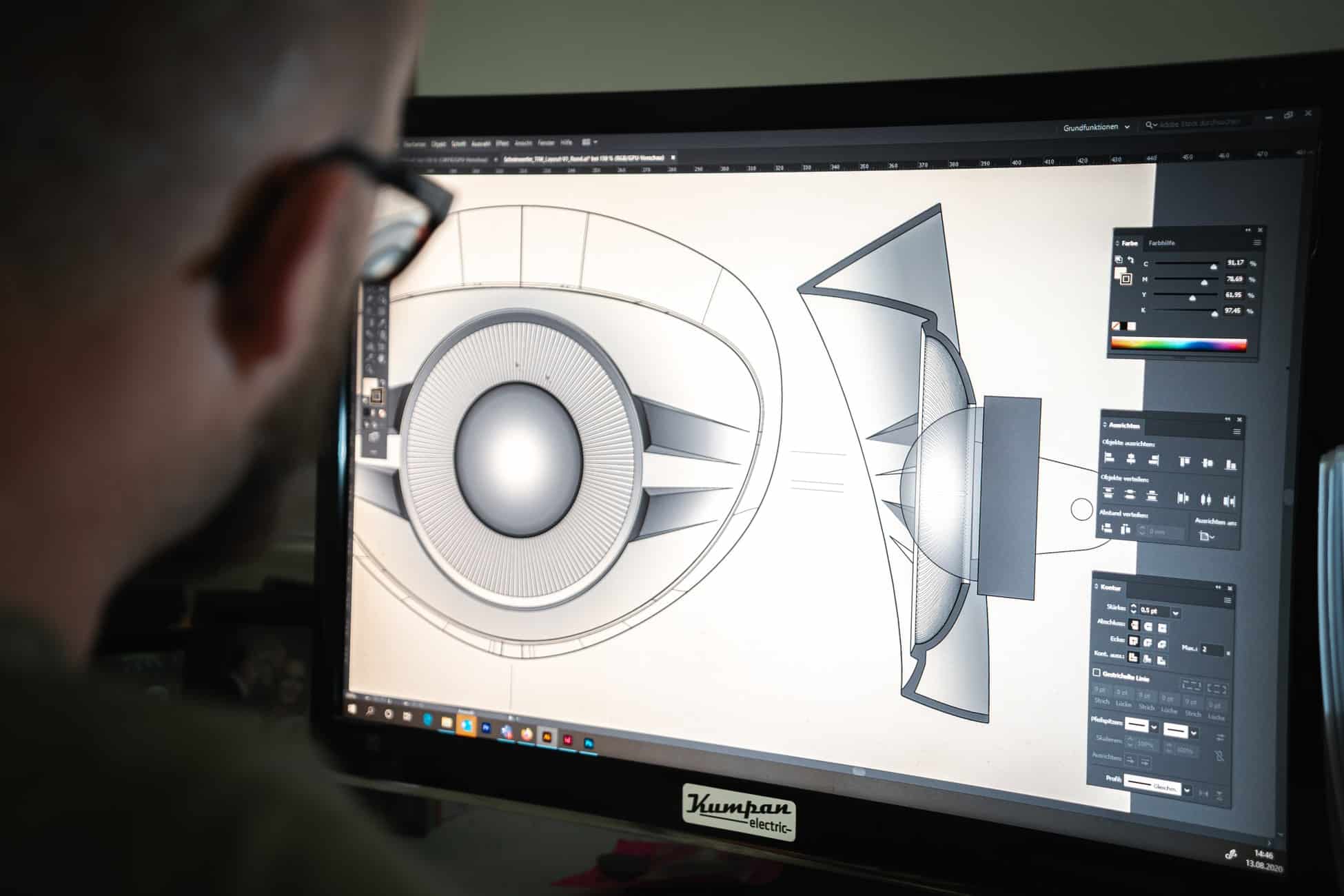

When many people think of Computer Aided Design (CAD), 3D renderings of complex engineering prototypes come to mind. However, CAD software is extremely versatile and has changed the design process across countless industries for the better.

The introduction of CAD made in-house research and development feasible for many organisations that previously lacked the resources to dedicate towards it. This is in part due to the fact that it is no longer necessary to invest significant resource (in terms of both time and materials) in designing, prototyping and proofing physical concepts, as CAD enabled these activities to be accomplished in a virtual setting with no material cost.

While physical prototypes are often still necessary further down the development road, the ability to design and test ideas in a digital environment alleviates much of the cost associated with the creation of new products. Because of this, CAD software has provided many SMEs with the tools they need to innovate, without requiring substantial reserves or capital.

That brings us to the relationship between R&D tax credits and CAD. In many cases, costs associated with testing, and the development of both 2D and 3D designs, can be recovered through the R&D mechanism; the caveat being the nature of the CAD activity.

If you’re using CAD to develop bespoke 2D or 3D designs in which the optimum design is not immediately obvious, or where there is uncertainty as to whether a suitable design can be developed at all, you are likely eligible to recover your costs.

Additionally, if you’re testing potential designs in the software and regularly forced to iterate and modify their configuration as a result, you will find an R&D tax credit application incredibly worthwhile.

If your company uses CAD and you’re unsure whether you should be applying, or if you’re already submitting applications but believe there’s money being left on the table, get in touch with one of our team – as always, we would be happy to help.